The crypto market has gained immense popularity over the past decade, offering exciting investment opportunities. However, it is often criticized for its volatility and instability when compared to traditional stock markets. Unlike stocks, which are evaluated based on company fundamentals, the crypto market is more influenced by speculation and short-term profit-seeking behavior. But why exactly is the crypto market less stable than its traditional counterpart?

1. Short-Term Focus: Quick Profits from ICOs and Presales

One of the primary reasons for the instability in the crypto market is the widespread focus on short-term profits. Many investors are attracted to Initial Coin Offerings (ICOs) and presales because they see an opportunity to make quick gains, often driven by the fear of missing out (FOMO). This short-term mindset leads to price swings, as people invest without understanding the long-term potential or value of a project.

In contrast, traditional stock markets are driven by investors who tend to focus on the long-term growth potential of companies. Investors evaluate a company’s performance, revenue streams, market position, and leadership before deciding to invest. As a result, the stock market tends to be more stable since decisions are rooted in fundamentals.

2. Lack of Understanding of Project Fundamentals

Another factor contributing to the instability of the crypto market is that many investors fail to understand the fundamentals of the projects they invest in. In traditional markets, investors carefully analyze financial statements, business models, and market trends to evaluate whether a company is worth investing in. However, in the crypto market, there is often a lack of deep understanding about the technology, team, and long-term goals of a project. Many investors are more focused on the hype surrounding new tokens rather than the actual development of the underlying project.

For example, a token may surge in price simply because of a successful presale or the promise of future gains, even though the project may lack a solid business model or product. This speculative behavior drives price instability, as quick buys and sells create erratic market movements.

3. Market Sentiment and Speculation

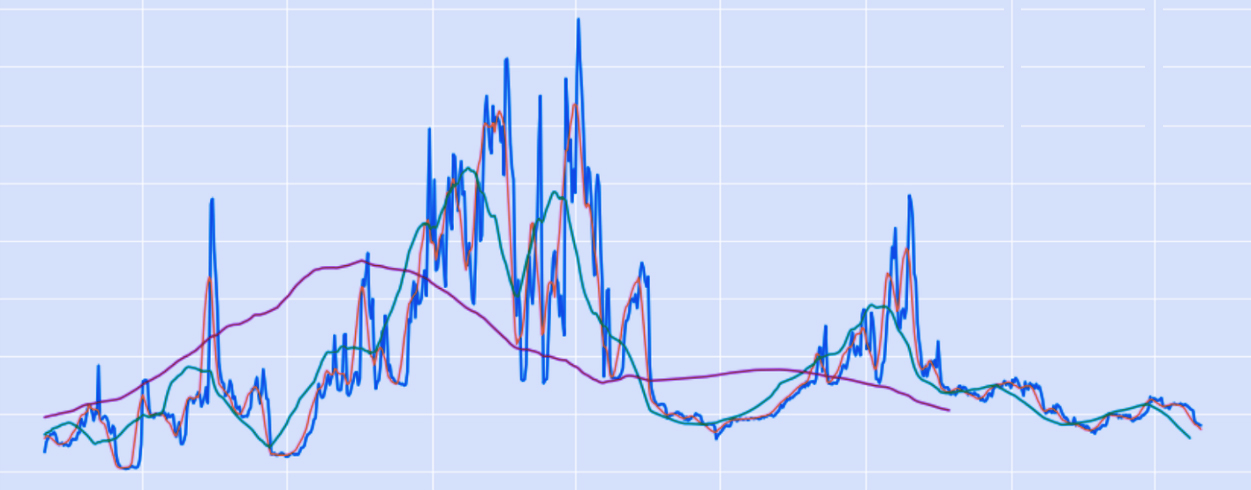

Unlike traditional stock markets, which are influenced by company earnings, economic conditions, and other measurable factors, the crypto market is often swayed by market sentiment. News, rumors, social media trends, and influencer opinions can lead to dramatic price changes. When major figures in the crypto world make announcements or when there’s hype around a particular coin, prices can skyrocket, only to fall again when the excitement dies down.

This speculative behavior creates volatility in the crypto market. In traditional stock markets, although sentiment does play a role, the impact is often muted by the presence of regulations, long-term institutional investors, and a focus on company performance.

4. Regulatory Environment

The crypto market also faces uncertainty due to a lack of clear regulations. While traditional stock markets are governed by established financial regulatory bodies like the SEC (Securities and Exchange Commission), the crypto space operates in a more loosely regulated environment. This regulatory uncertainty adds to the market’s volatility, as unexpected government actions or changes in policy can significantly impact crypto prices.

In traditional markets, regulations and oversight help to maintain stability and trust, ensuring that investors are protected from fraud and manipulation. The absence of such measures in the crypto space can lead to erratic market behavior, as speculative investments and pump-and-dump schemes often occur without sufficient safeguards.

5. The Solution: Evaluating Fundamentals Before Investing

To bring more stability to the crypto market, it’s crucial for investors to adopt a more disciplined approach, similar to what is used in traditional stock markets. Instead of buying into the hype of an ICO or presale, investors should take the time to understand the project’s fundamentals. Key factors to consider include:

- The technology behind the project: Is it innovative and scalable?

- The team behind the project: Are they experienced and reputable?

- The utility of the token: Does the project offer real-world use cases?

- The roadmap and long-term goals: Does the project have a clear vision for the future?

By focusing on these fundamentals, investors can make more informed decisions, which will ultimately help stabilize the crypto market and reduce the speculation-driven volatility that currently dominates the space.

Conclusion

The crypto market’s instability compared to traditional stock markets is primarily driven by speculative behavior, a focus on quick profits, and a lack of understanding of the projects being invested in. To achieve more stability in the crypto space, investors need to adopt a more thoughtful, long-term approach by evaluating projects based on their fundamentals. This will not only help reduce volatility but also contribute to the growth and maturity of the crypto industry as a whole.